To support economic relief from the COVID-19 pandemic, Congress passed a new ‘lookback rule’ which means if you earned less in 2020 or 2021, you can use your 2019 earned income for your Earned Income Tax Credit if it gets you more money.

Although the lookback applies for either Tax Year 2021 or Tax Year 2020, the following blog will assume you’re filing for Tax Year 2021.

There are two ways to take advantage of the lookback option.

If you file taxes with a tax preparer (at a VITA or Tax-Aide site, through GetYourRefund.org, or elsewhere):

- Find your 2019 tax return.

- Bring your 2019 return to your tax appointment.

- You’re done!

If you’re filing your own taxes:

- Figure out your 2019 earned income. This is important to determine correctly. (See more below.)

- Enter your 2019 earned income into your 2021 tax return when prompted.

Can’t find your 2019 tax return? You’ll find some options below.

How to find your earned income

There are three main ways to find your earned income, depending on what forms were completed for your 2019 tax return.

Method 1

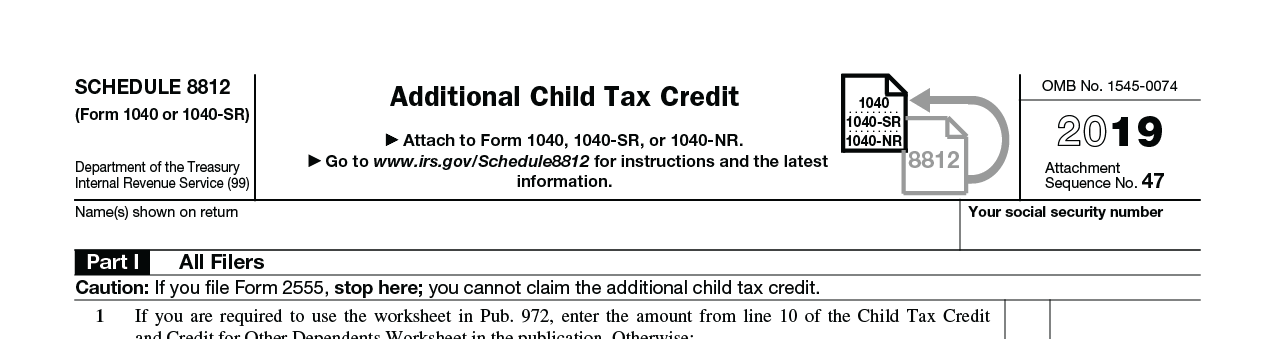

First, look through your 2019 tax return. Do you see Form 8812?

If yes, find Line 6A. That’s your 2019 earned income. Skip down to how to fill out the lookback on your 2021 tax return.

Method 2

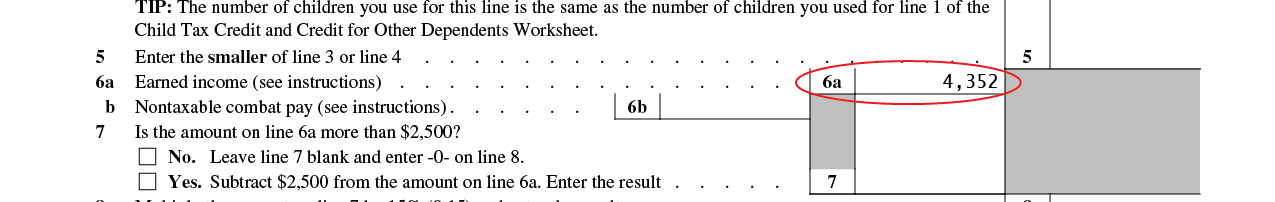

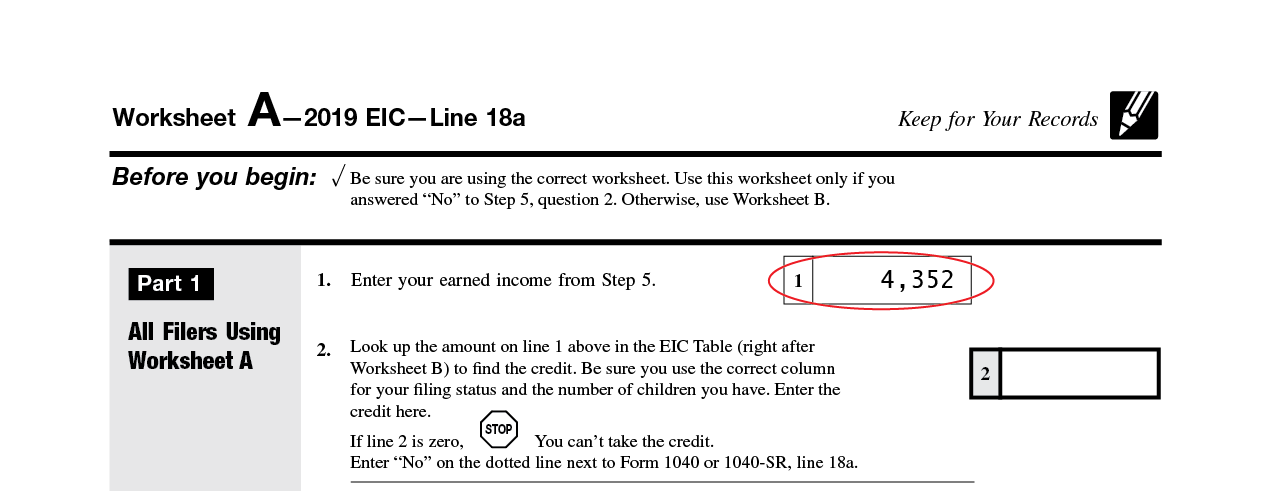

Look through your 2019 tax return. Do you see the EITC Worksheets? They should be at the end of the tax return. If so, look for Line 1 on Worksheet A. That’s your 2019 earned income. Skip down to how to fill out the lookback on your 2021 tax return.

Method 3

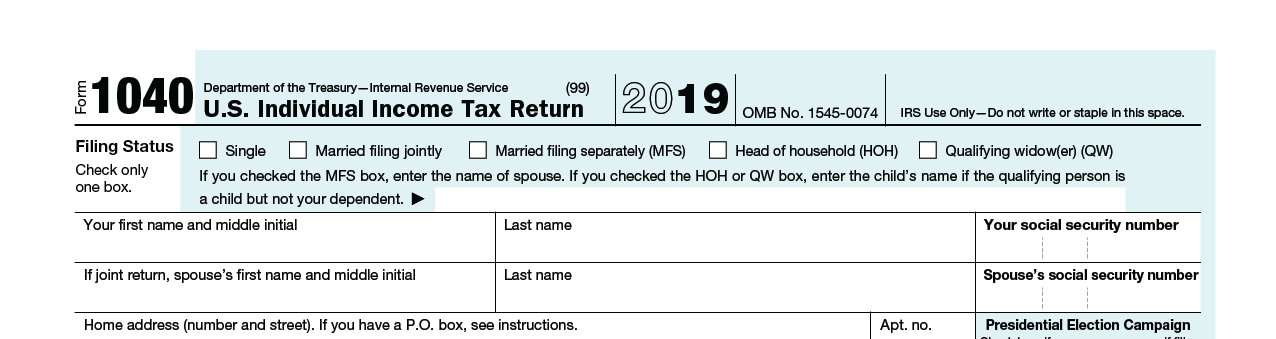

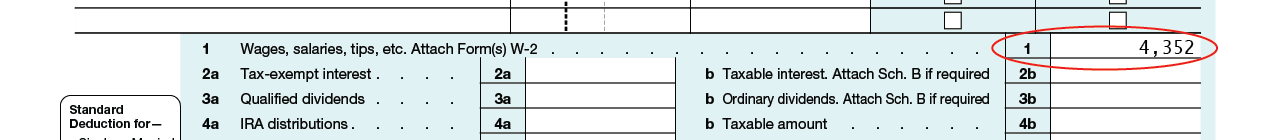

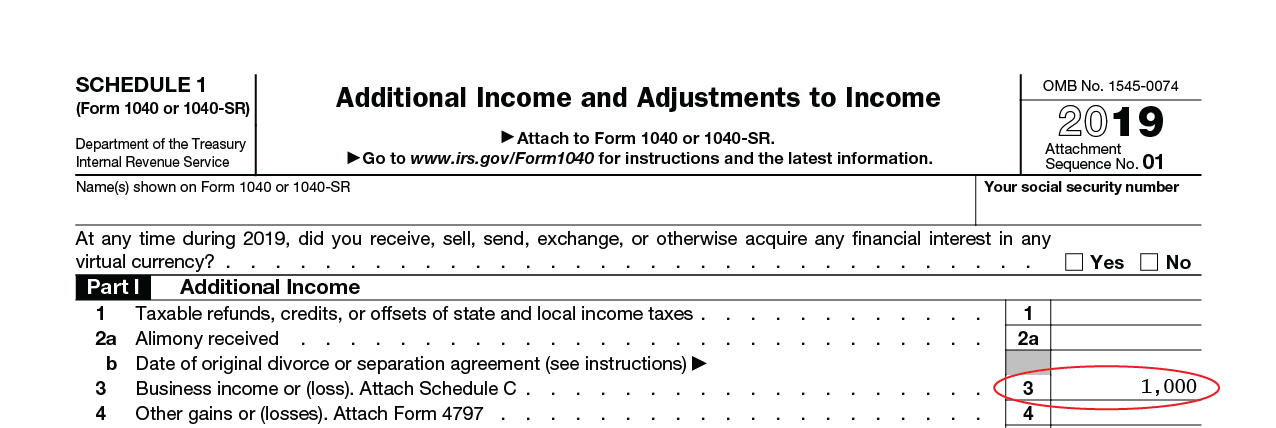

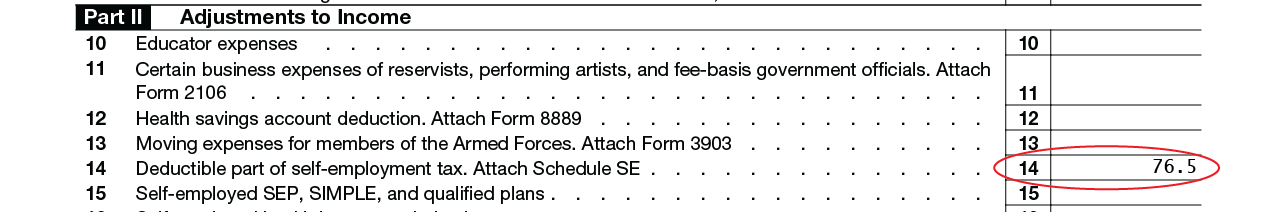

Find Form 1040 and Schedule 1 if you were self-employed (remember, gig work counts!).

On Form 1040, find Line 1 on the middle of the first page. If you were NOT self-employed, and only received pay from your employer(s), that’s your 2019 earned income.

If you were self-employed, even for just some of the year, find Schedule 1.

For your earned income, subtract Line 14 of Schedule 1 (under “Adjustments”) from Line 3 of Schedule 1. Add this number to Form 1040 Line 1 from earlier. That’s your 2019 earned income.

Note: If you have taxable scholarships not reported on Form W-2, amounts received for work from a penal institution, non-qualified plans shown in Form W-2 Box 11, or an amount that is a Medicaid waiver payment that is excluded from income, you’ll need to subtract those amounts from your earned income. These are very uncommon, so details aren’t included in this earned income guidance.

How to fill out the lookback on your tax return

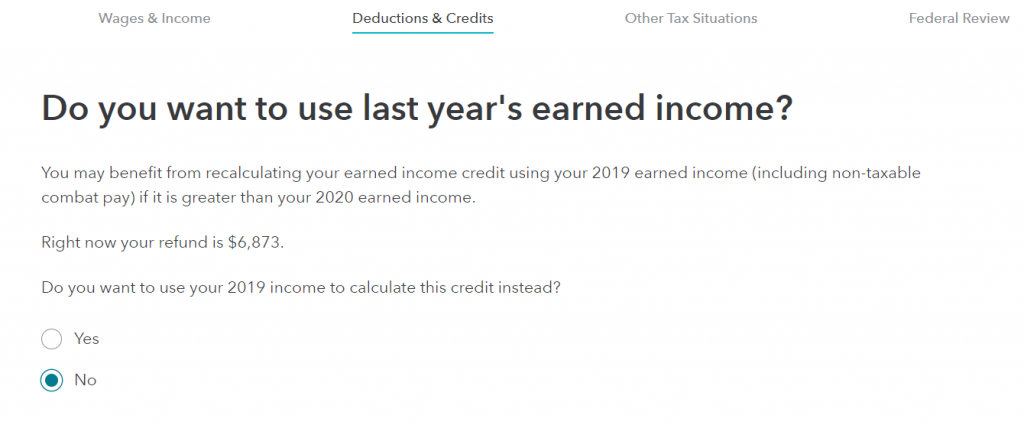

When filing your own taxes, how you fill out the lookback on your tax return will depend on the tax software you’re using. There will be two main steps. First, identify where the lookback option is, and second, enter your 2019 earned income that you found earlier.

1. Find the lookback option.

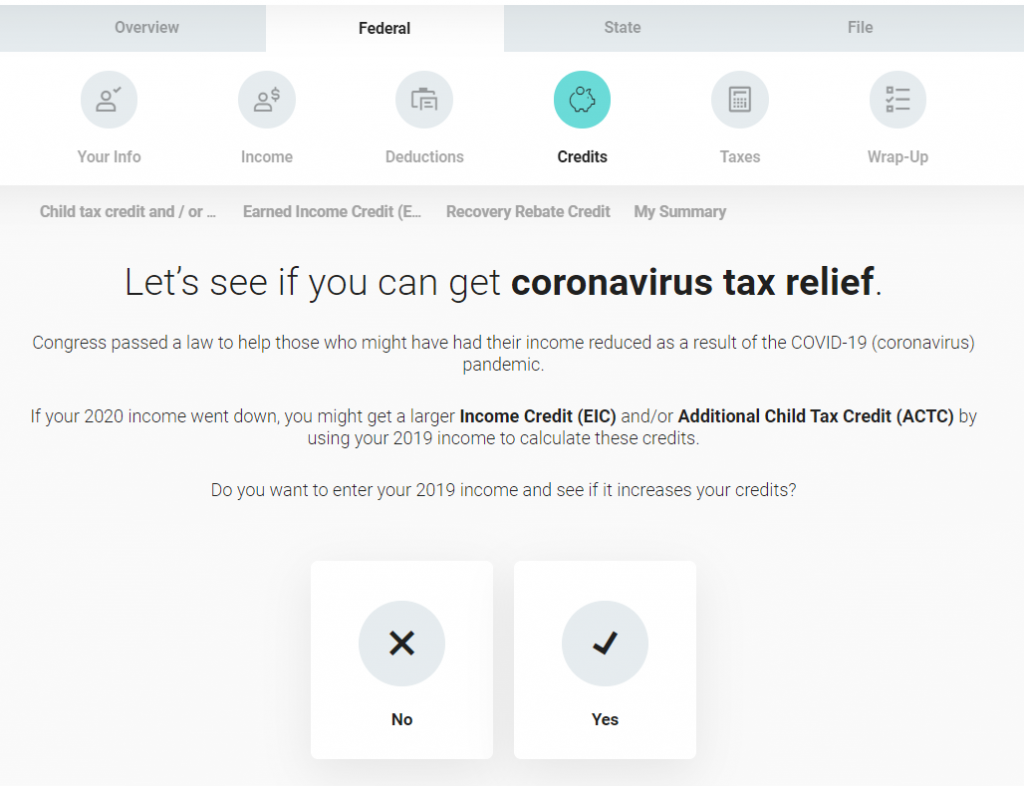

There are a couple ways the tax software will prompt the lookback. Most tax software will ask you if you want to use your 2019 income in the tax credits section. Here are examples of how it may appear (shown below are TurboTax and H&R Block). For any tax software, look for phrases like “use last year’s earned income”, “2019 earned income” or “coronavirus tax relief” on the page.

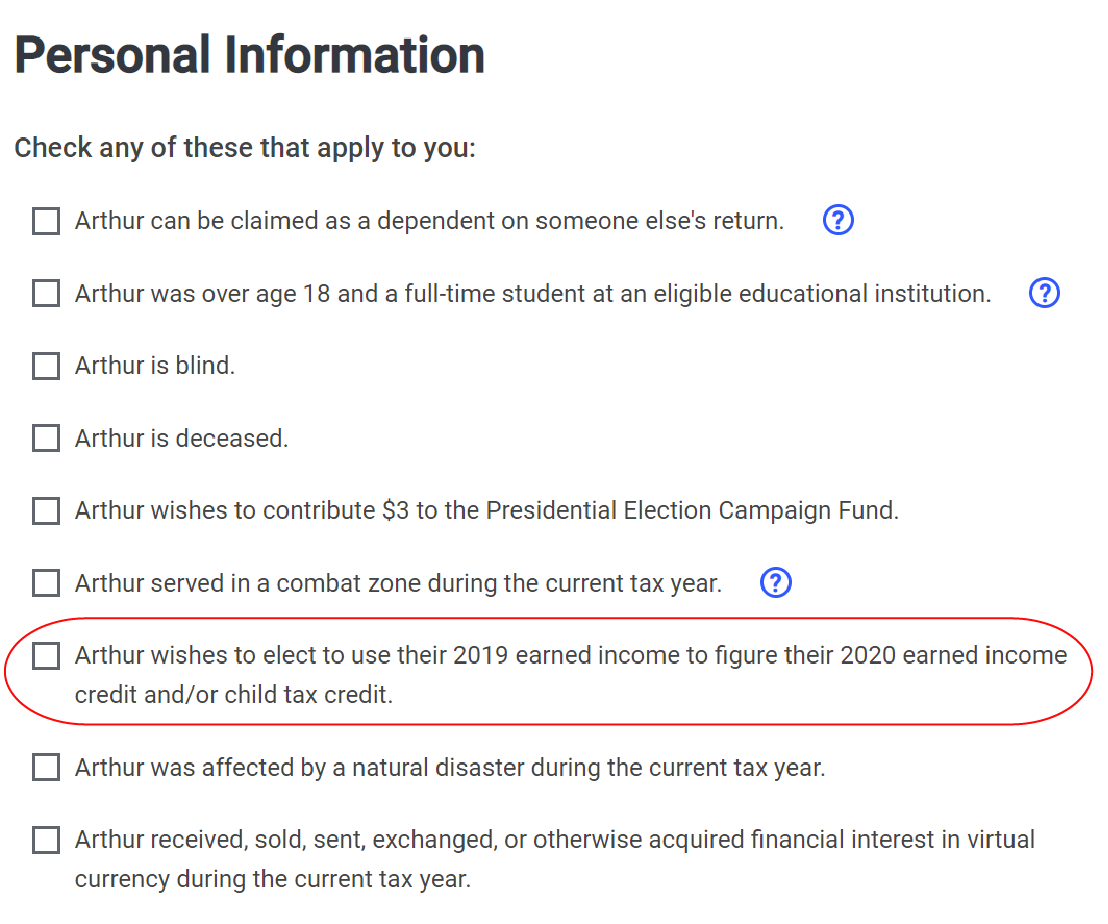

A less common way you may be asked about the lookback is “[Your name] wishes to elect to use their 2019 earned income to figure their 2021 earned income credit and/or child tax credit.” If you see this option on a checklist, check the box. Look for “2019 earned income” and “2021 earned income tax credit.” The following image is from MyFreeTaxes and TaxSlayer.

2. Enter your 2019 earned income. Once you check the box, you’ll need to enter your 2019 earned income.

Most tax software will automatically calculate which year will give you a higher refund from the EITC and ACTC (Additional Child Tax Credit).

If you use TurboTax, the software will give you instructions for how to figure out which year’s income to use.

Can’t find your 2019 tax return?

You have a few options.

If you filed your tax return with a tax preparer, give the tax preparer a call. Ask them to send you a copy of your 2019 tax return with all the worksheets.

Another option is to request a tax transcript from the IRS. You can request online or by mail. To request online, you’ll need your SSN, date of birth, filing status, mailing address from your latest tax return, access to your email account, personal bank account numbers, and a mobile phone.

To request via mail, you’ll need your SSN or ITIN, date of birth, and mailing address from your latest tax return. Due to the coronavirus, the IRS has a large backlog of unopened mail. Online requests are strongly encouraged.

Another option is to recreate your 2019 tax return. You can do this by gathering your tax forms from last year, including any Forms W-2 or 1099. It will be easier to do this with help from a tax preparer.

This information is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities is not liable for how you use this information. Please seek a tax professional for personal tax advice.