The government issued three rounds of stimulus checks to help with relief from COVID. Stimulus payments were available for eligible adults and children. The amounts for each round of stimulus checks for children were $500 (first stimulus), $600 (second stimulus), and $1,400 (third stimulus).

If you didn’t get the full amount of one or more of these for your eligible children, you can claim the amounts as the Recovery Rebate Credit when you file your 2020 and/or 2021 federal tax return. You can file a 2020 tax return to claim the first and second stimulus checks through April 15, 2024. You can file a 2021 tax return to claim the third stimulus check through April 15, 2025.

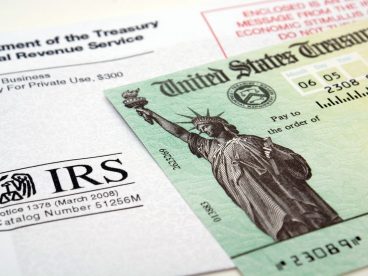

It is helpful to know the amounts of the stimulus checks that you received to complete the Recovery Rebate Credit worksheet on your 2020 or 2021 tax return. You can look at your Notice 1444, 1444-B, or 1444-C, which was mailed to you and shows the amounts that you received. You can also check your bank statement if you had your payment direct deposited. If you no longer have the IRS notice(s) or received a paper check, you can provide this information based on memory.

Remember, you must file a tax return to receive these credits even if you don’t normally have to file taxes.