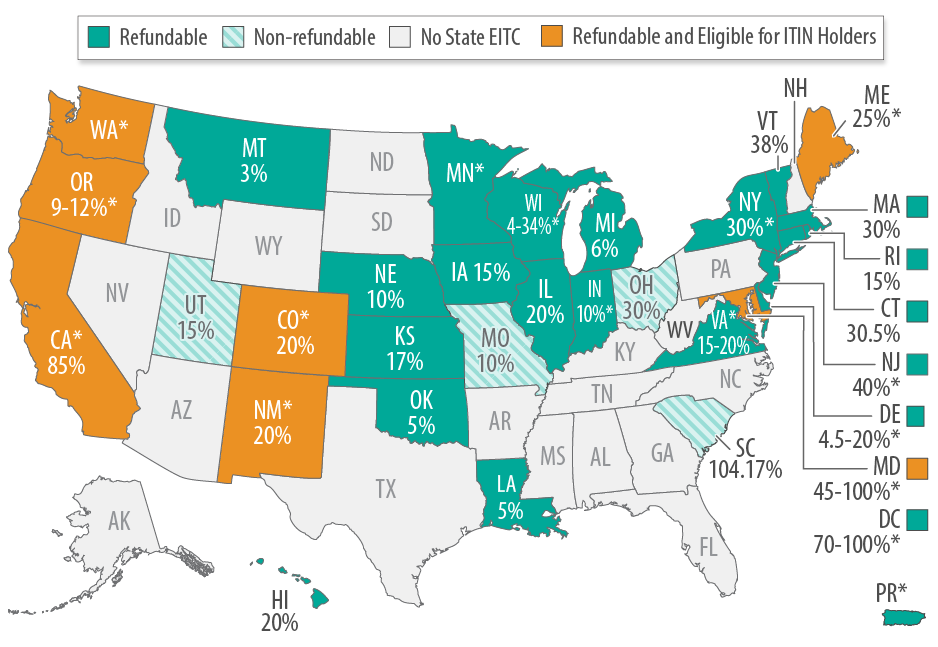

In addition to the federal EITC, state-level EITCs can make more money available to workers with lower incomes while showing a state’s effort to reduce poverty among working families. Most states with state EITCs set their benefit as a percentage of the federal credit, making them easy to deliver. Nearly all state EITCs are “refundable,” making them available to workers even if they do not owe state income taxes.

For more information on state EITCs or starting an EITC in your state, see the following Center on Budget and Policy Priorities reports:

- How Much Would a State Earned Income Tax Credit Cost in Fiscal Year 2021?

- Policy Basics: State Earned Income Tax Credits

- States Can Adopt or Expand Earned Income Tax Credits to Build Equitable, Inclusive Communities and Economies

*California’s EITC is 85% of the federal EITC up to half of the federal phase-in range. Eligibility is based on income. Workers over 18 years old and workers over 65 years old are eligible. Children under 6 years of age receive an added $1,000.

*Workers over 19 years old are eligible for Colorado’s EITC.

*The District of Columbia’s EITC is 100% for workers not raising children at home and 70% for workers with children. DC also allows certain non-custodial parents who are making child support payments to claim a state EITC that is greater than the credit taxpayers without qualifying children might otherwise claim.

*Delaware’s EITC is partially refundable. Workers can choose a 4.5% refundable credit, OR a 20% non-refundable credit – whichever is higher.

*Indiana’s EITC does not account for expansions to the federal EITC for married workers and for families with three or more children.

*Maine’s EITC is 50% percent for workers without children and 25 percent for families with children. People qualify starting from 18 years old.

*Maryland’s EITC is 45% for families with children and 100% for workers without children (capped at $530). Filers can also choose a 50% non-refundable credit.

*Minnesota’s EITC varies with earnings, starting at 37% of the federal credit. Workers qualify starting at 21 years old.

*Workers not raising children at home qualify for New Jersey’s EITC starting from 18 years old. Workers over 65 are also eligible.

*Workers not raising children at home qualify for New Mexico’s EITC starting from 18 years old.

*New York allows certain non-custodial parents who are making child support payments to claim a state EITC that is greater than the credit taxpayers without qualifying children might otherwise claim.

*Oregon’s EITC for workers with children 3 years and younger is 12% of the federal EITC. Starting in 2023, more than 400,000 households with low and moderate incomes across the state will get an annual financial boost of up to $300 for a single person and $1,200 for a family of four or more through the credit.

*Virginia’s EITC is partially refundable. Workers can choose a 15% refundable credit, OR a 20% non-refundable credit.

*Washington’s EITC is a flat rate based on income and number of children. The credit is worth $300 per child and maxes out at $1,200.

*Wisconsin’s EITC is based on the number of children. It is 34% of the federal credit for workers with 3 children; 11% of the federal credit for workers with 2 children; 4% of the federal credit for workers with 1 child; and zero for workers not raising children at home.

*Puerto Rico’s EITC is a flat rate based on family size, with credits between $1,500-6,500. This credit is refundable, and available to workers over 19.

Three local governments — New York City, San Francisco, and Montgomery County, Maryland — offer local EITCs. Note: The San Francisco credit is currently only available to first-time recipients.