As a self-employed worker, tax deductions for business expenses are the best way to prepare an accurate tax return and lower your taxes. You can deduct common driving expenses, including fees and tolls that Uber and Lyft take out of your pay. Your biggest tax deductions will be costs related to your car. You may also want to deduct other expenses like snacks for passengers, USB chargers/cables, or separate cell phones for driving. If you don’t take these deductions, more of your income will be subject to both income and self-employment taxes.

Due to COVID-19, you may also have Personal Protective Equipment (PPE) expenses like face masks, hand sanitizer, shields, etc.

If you are a food courier, you might have different deductions, like food courier bags, backpacks, and blankets. For example, if you bike you can deduct the cost of bike repairs and equipment.

Preparing to file taxes and tracking tax deductions

Make sure to track tax deductions as you go—it is much harder to recreate records later! Compile a list of these tax deductions (with receipts) and a mileage log so you’re prepared to file. Tracking business expenses can also help you determine whether your driving is profitable.

Here are some tips to help you prepare your tax deductions for filing:

- Create a system to track your tax deductions. Make sure you understand which expenses can be deducted and track whenever an expense occurs. It doesn’t matter if you use an an expense-tracking spreadsheet (printable spreadsheet) or an expense-tracking app, just be consistent.

- Keep a separate bank account or credit card for business. This can be a great way to keep personal and driving expenses separated. You will also be able to look back to your bank and credit statements for records as you’re filing your taxes.

- Use apps to help you. Apps can make tracking tax deductions much simpler, especially when tracking mileage. Two popular apps are Stride Tax (free) and MileIQ ($5.99 billed monthly for unlimited trips, free for the first 40 trips).

- Pay special attention to tracking mileage. If you drive, the mileage deduction will likely be your largest tax deduction. It’s important to carefully track your miles because the IRS requires a mileage log. Read the Mileage Deduction Guide for more information.

- Review your driver dashboard. The dashboard contains important information that is generally not available elsewhere. Your annual income will be included here, as well as some of the tax deductions you qualify for. You’ll find the tolls as well as commissions and fees that Uber and Lyft take out of your pay.

What can be deducted?

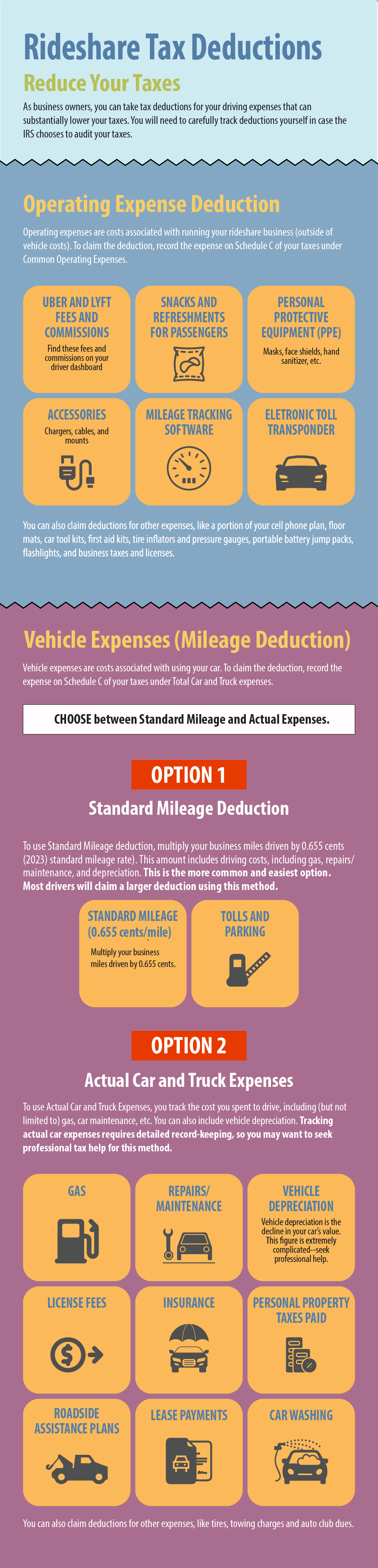

There are two categories of deductions that you can take, “operating expenses” and “vehicle expenses.” Vehicle expenses are those related to driving your car, including mileage, parking and tolls. Operating expenses are all other expenses, including Uber and Lyft fees and commissions, snacks for passengers, and cost of cell phone plans.

Tax deductions must be expenses made purely for business reasons. If an expense also benefits you personally, only the portion attributed to your business is deductible. For example, you may have a cell phone that you use for driving about 25 percent of the time. In that case, you can deduct 25 percent of the phone bill as a tax deduction.

There are two ways to deduct mileage. That will affect which expenses you can include.

- Standard mileage. Multiply your business miles driven by the standard rate. For 2023, the standard mileage rate is $0.655. The rate includes driving costs, gas, repairs/ maintenance, and depreciation. Do NOT deduct these costs separately. This is the more common and easiest option.

- Actual car expenses. Track all of your driving expenses yourself. Actual car expenses are difficult to track, so seek professional tax help. With this method, you can deduct a percentage of your actual costs for gas, repairs, vehicle depreciation, insurance, and other vehicle-related costs. This number is based on the percentage of time you use the vehicle for driving. Keep in mind that you will need to have receipts to support these expenses.

The following graphic covers the various tax deductions that you can take.

How to claim business expense tax deductions on your taxes

How to claim business expense tax deductions on your taxes

You will file Schedule C to report your profit to the IRS. On this form, you record all your income and tax deductions. You pay taxes on your net income, which is your total income minus any business tax deductions.

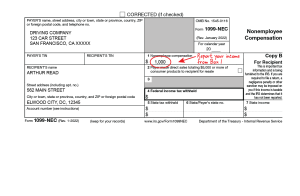

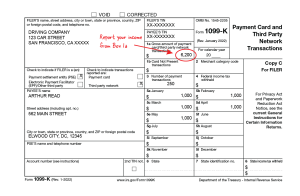

You’ll find your income information on the Uber or Lyft driver dashboard. You may also receive two tax forms, Form 1099-K and Form 1099-NEC. The dashboard and forms will record your income and some of the tax deductions you qualify for.

Click on the sample 1099-K and 1099-NEC below for full images:

Including tax deductions on your Schedule C

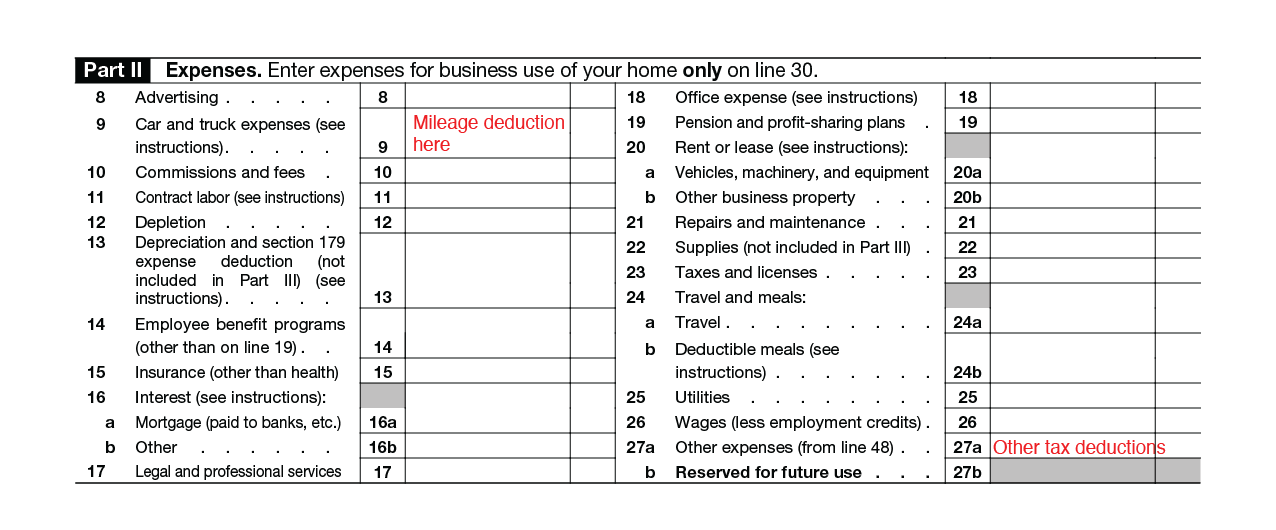

Your tax deductions related to vehicle expenses will go on Line 9, Car and Truck expenses. You’ll find this section under Part II of IRS Form Schedule C. For those who use standard mileage, this will include the standard mileage rate and tolls and parking. For those who use actual expenses, include all vehicle-related expenses here.

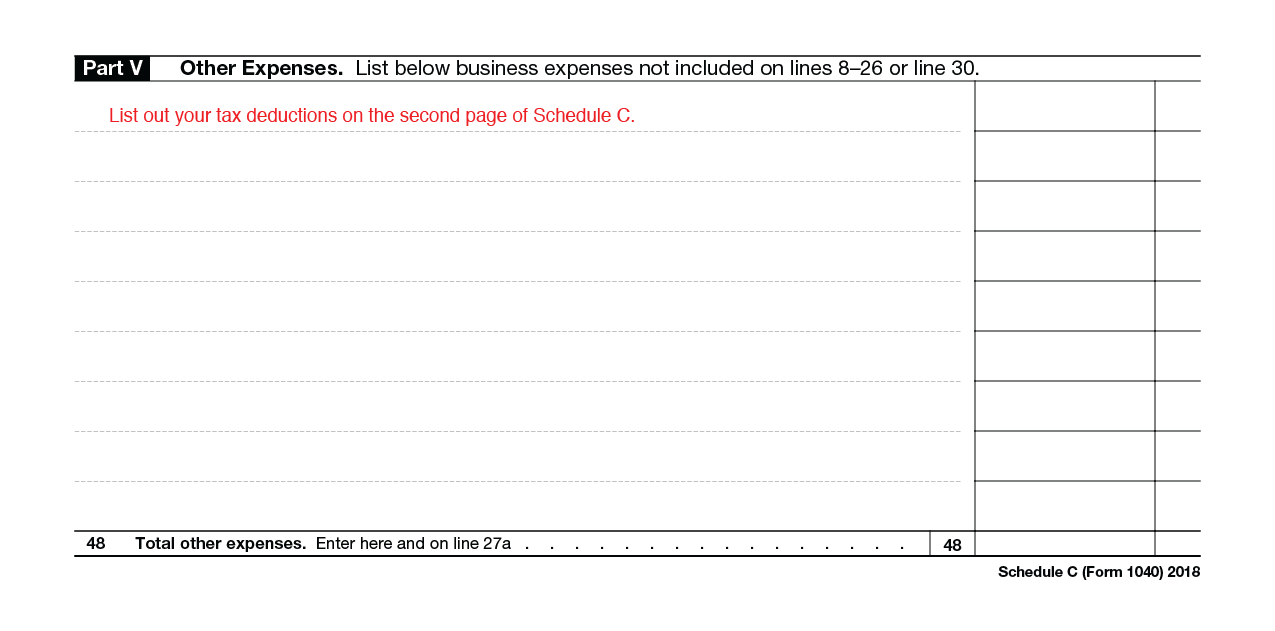

The rest of your tax deductions will go on Line 27a, Other expenses. You’ll also find this section under Part II. You’ll list out these expenses on Part V, Other expenses (Line 48). This can include Uber and Lyft fees and commissions, Lyft’s Express Drive Rental fees, snacks for passengers, the portion of your phone bill that you use for your job, etc.

You’ll record additional mileage information on Part IV of the Schedule C. Part IV asks questions about your vehicle. Record your total number of business miles, commuting miles, and all other personal miles. Do this separately for each car you drove that calendar year.

Sample Schedule C expenses:

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities and the CASH Campaign of Maryland are not liable for how you use this information. Please seek a tax professional for personal tax advice.